Well, I am no economist, but as a saver all my life I do admit to thinking about money, inflation, appreciation and all the like. My interest is a practical one, and not so much trying to develop universal equations, but rather enough of an understanding so that my efforts to save and build a nest egg can be as efficient and effective as possible.

OK....I am just saying that I am no expert, but still I try to learn enough to play the game.

I will not get into the details of my investments, or even all the views I hold about the state of the world.....but let me just say that I feel the world is under economic tension right now, and that tension is manifesting itself in many things "not acting in what we used to think of as normal"......and there are plenty of things....starting with interest rates being this low for this long. IMHO, that is creating all sorts of distortions.....any savers out there say over 40 will probably appreciate the fact they in order to even stay where you are, we are all pushed to higher and higher risk assets.....and then there is the amazingly low level of volatility we have experience in the past year or more......not normal, and IMHO creating a "pressure" somewhere that will eventually come unhinged.

(be careful, I am not saying CRASH.....just unhinged with might simply look like a slide into a direction that doesn't even seem to make sense)

Ok....so I have always thought that we in say the USA have been benefiting from what I call a deflationary input cost environment. That is, with labor and raw materials sourcing going to places like China, Mexico and Vietnam, we have benefited

(overall) from the fact that input costs could go down, and our companies could do several things......either lower prices, or raise wages....and they did a combination of both. As input prices continued to fall as more and more of our production was moved.....we continued to benefit....and we have been trying to develop the political system to "re-distribute" that wealth that was coming in to those sitting at the arbitrage points where these delta's were most present.

(I am not going to vilify anyone or any group, that is not the point...just think about it as trying to "FIX" the wealth gap that has been increasing.)

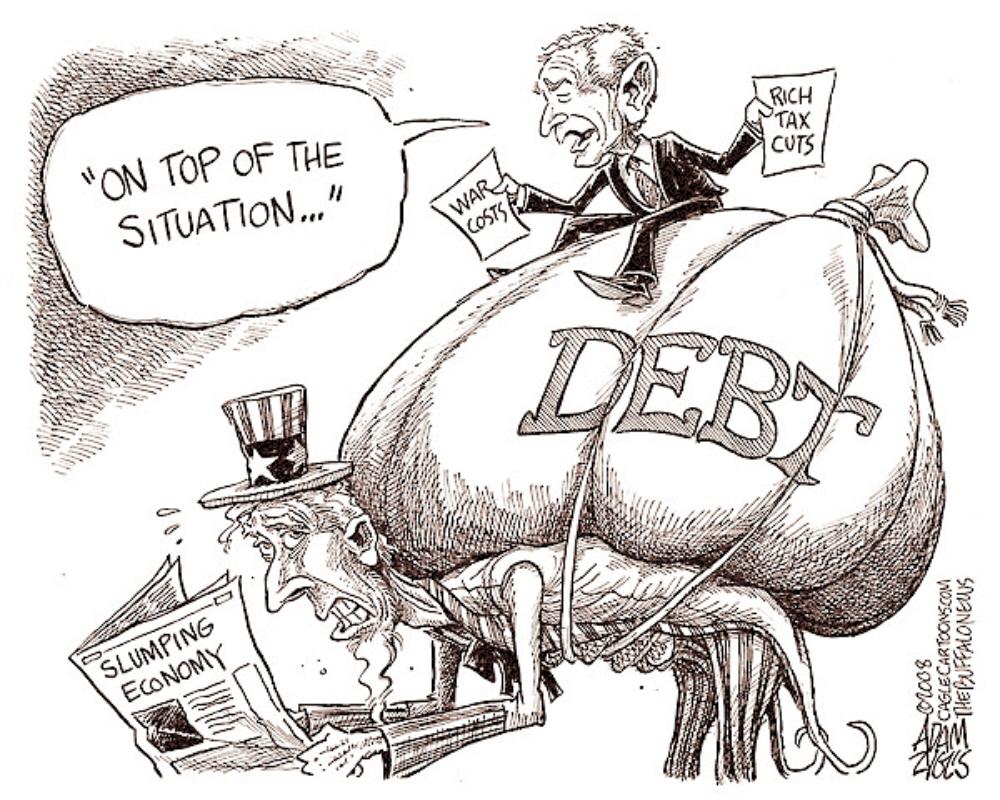

So what happens when the gravy train ends....that is, once input / labor costs can no longer go down further, and we don't have the capability

(for cost and skill reasons) to take back that production and do it ourselves. Oh, and what happens when we continue to spend beyond our means and essentially borrow the money from the very folks we outsourced out production to....and even more recently, to ourselves......how do we unwind all of that.

I have always thought we would eventually be "forced" by those we owe the money to

(and think of yourself on Social Security, and how you would feel about getting what you think you deserve there) to pay back what we owe.....so I thought our first step was balancing a budget, and then we could just create a modest amount of inflation and essentially pay people back with "slightly less valuable" dollars.....but we have NO plans to balance a budget.....but even if we did, inflation is the key.

Well, it seems to be rearing it's head now......yes, there have been other indications in the past, stock and bond prices.....housing prices......but now I see clear evidence in retail when I look at prices at low-cost suppliers like Walmart and Market Basket....and I think you see it there first because their margins are so low that find it hard to absorb any increases.....they generally will pass them on.

Well, first off I see sardines.....they have risen from $1 per can to between $1.18 and $1.25. Then, those "fake" stacking potato chips in a can that used to sell for $1 per can have slowly moved up to between $1.15 and $1.50.

(some of the other things are harder to see because they have experienced size decreases rather than price increases.....so I am sure there are plenty of other examples, just more difficult to see...like the "clearance" prices for shirts/pants and shows going steadily up over the last 9 months....from say $7.00 per item to $9 or $11)

But the reason I came to even write this was because earlier in the week bought three Ni-Mh replacement batteries for my wireless home phones from a company with Chinese batteries....and my EBay cost was $4.99. Within three days I received an email telling me there was a quality problem and they wanted to cancel my order.....which I allowed because I didn't want a quality problem battery....but I expected that ALL their batteries would have been removed from EBay, else they would have just told me there would be a delay...but when I went right back I found the price from the same vendor was not $6.99 for the same three batteries! They probably cancelled my order because of currency valuation shifts that resulted in them suddenly losing money on that auction.....and they of course are not in business to do that....

Anyways.....I am not sure how much of our price inflation will be coming from the recent currency devaluation of the USD....and I am pretty sure the food prices I describe above were NOT the result of that.....so I wonder if what I am finally seeing is perhaps the front edge of a wave of increases coming out way.....how large or long the wave, I have no clue.....it might affect companies internally initially.....in places like budgets, where they cut back on coffee and fringe benefits....or it might come right out into product prices. We shall see.....fasten your seat belts!

(I hate to make predictions.....our economy has so many ways to tolerate and adjust)