Interest Rates Going Up.....Costs (Inflation) Going Up......Next Thing To Watch, Zombie Companies!

WHAT IS A ZOMBIE COMPANY?

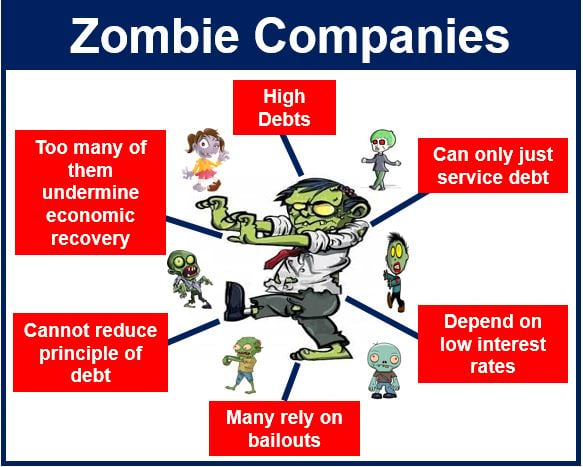

This is how Investopedia defines a Zombie Company....."What Are Zombies? Zombies are companies that earn just enough money to continue operating and service debt but are unable to pay off their debt. Such companies, given that they just scrape by meeting overheads (wages, rent, interest payments on debt, for example), have no excess capital to invest to spur growth." ( https://www.investopedia.com/terms/z/zombies.asp )

WHY WORRY NOW?

Well, first we are talking about supporting debt....that means the company is going to be rolling over debt at ever increasing interest rates. The debt costs for them will be rising!

Second, the inflation we have been seeing is pushing up input costs for everyone, including these Zombies.....so as the definition describes them of barely having the money to continue on as a going concern, so rising input costs can't be a good thing. If they had better pricing power in their industry, they would NOT be running their company so close to losing money.....increasing input costs can only hurt their cash flow.

Oh, and the slowing economy only applies pressure to their incoming revenue stream...their customers will likely diminish and so they will see pressure on their money flows coming in.

These three things don't guarantee failure, but they surely apply negative pressure to EVERY company, and so those are are so close to failure might well step "over the edge" and so fail.

HOW DID I COME TO THINK ABOUT ZOMBIES?

Well, the conversation about zombie companies have gone on for the longest time when we went through not only the DOT COM crisis and then the housing crisis. Not just US companies, there are many all across the world, but the lost interest environment has allowed these companies to take on more and more debt to keep their operations going.....as interest rates go down, they can take out more debt at the same cost....they can "kick their debt problems down the road". Increasing interest rates have the opposite affect.

So I came to think about this again when I came across several articles....and this first one has a pretty good analysis of current times / situation.

- First one on USA and Australian Companies: https://www.livewiremarkets.com/wires/up-to-one-third-of-all-australian-and-us-companies-could-be-zombies

- Second, and article written by the Federal Reserve Board of Governors: https://www.federalreserve.gov/econres/notes/feds-notes/us-zombie-firms-how-many-and-how-consequential-20210730.html

HOW DOES ONE FIND ZOMBIES?

Well, first I suppose it makes sense to look at what others feel to be Zombie companies....here is one list: https://finbox.com/ideas/zombie-companies-list

Then I think we each need to be able to look at a companies balance sheet and cash flow statements to see how they keep their company afloat....whether their actual business was enough to keep their "lights on". One thing that you might find in a zombie is their need to continuously add debt in order to continues existence....debt without say growth or productive capacity increases.....but the other thing you might find is a company that is "hollowing itself out" by needing to sell of assets in order to keep the money coming in so they can keep the lights on.....but if the sales of those assets is resulting in them lowering their productive capacity (which will ultimately lower revenues in the future.....that is a bad recipe for a downward spiral)

WHAT NEXT?

I suppose I need to add this to the analysis of the stocks I have in my 401K investment.....I tend to look a lot at their dividend cash flow, and the general health of the balance sheet....but I other than total debt and things like Quick Ratio and Current Ratio, but I need to look closer at their debt trajectory. (and figure out how to do that easily)

0 Comments:

Post a Comment

<< Home