Will US GDP Grow This Quarter? (if not, will this be called a recession???)

HOW IS OUR ECONOMY DOING, AND WHERE IS IT TAKING US?

Most of my friends probably don't think it really matters whether they know how our economy is doing or where it is going because it is "out of their control".....and I agree, but only to a point.

It is clearly outside our individual control, but like a sailor measuring the wind direction and speed, knowing the economy and its direction is very important to all of us interested in navigating our future. (in so far as how much any of us actually navigate and don't just float along like a log)

Well, there is an obvious first order way that is available to most everyone who controls their own finances.....that is just their own personal / family budgets. I mean how much each of us gets for income and then in expenses and how that affects our discretionary spending. (or how much we can save) IMHO, that is a lagging indicator....I mean this is not at all forward looking, and everything that made this situation occurred happened at some point in the past....setting our sails based on past history is not very useful.....the only use it is to us is to show us is whether we ARE -or- ARE NOT going in the direction we desire. (As a first order approximation, that might be be enough to kick us into action, but in terms of defining the action to do what, I don't think there is enough information)

WHAT OTHER METRICS THEN?

Well, the next thing we have to decide might be whether the general macro environment is getting better or worst....whether there is overall expansion or contraction. That is actually quite important because the notion that a rising tide lifts all boats is a truth.....and knowledge of this simple idea will help us better appreciate whether we might want to think more about next moves for opportunity or defense. (One can and should still look for both, but knowing general overall conditions might allow us to know more about how "everyone else" might be moving.....where the opportunity / dangers might be)

I suppose most folks will take to the news media for their first measure. I warn folks right up front that as we look for ways to measure things, we try to understand the incentives those giving us that data might have...."what's in it for them".....or perhaps "follow the money". That is not to imply that they will lie so much as at times lay their "thumb" on their measuring scale and allow their analysis to drift in the direction that benefits them. We all know this as being obvious when we think about the modern term "click bait".....which is not so new really when you think of the fantastic headlines we have seen in the years growing up on the headlines of the National Enquirer as we were in the store checkout lines.

Now this isn't to say we can't trust our media....mainstream or otherwise, just that we have to realize that once they go beyond just reporting a particular number or statistic and then go on to "explain" that it means, they are moving into the arena where their own judgement and prejudices are going to work. (ditto for us too.....it is a human thing)

THE NEXT UP, OFFICIAL STATISTICS KEEPERS

The next step beyond personal intelligence is probably intelligence of close friends and associates. It makes sense to "ask around" and take the temperature of those around us....and knowing them only allows our BS detectors to work more perfectly since we can measure the information they provide better.

But beyond that, there are plenty of other places to look for data.....some are more useful and accurate than others...and of course, NONE are going to assess black swan events.....but that is another thing all together, and IMHO, something we should consider, but isn't covered here.

--> NH STATE DATA

States often have official organizations that look over the state and keep track of lots of statistics and metrics that I suppose elected leaders of the state would use to appreciate the conditions for future legislation and impacts of past legislation. But the date these state organizations roll up can be very useful to us too.

- The state of NH has a department has a website on NH Employment Security, and here is their introduction site: https://www.nhes.nh.gov/elmi/products/vs.htm

- They also roll together reports under this page by the Economic and Labor Market Information Bureau, which publishes very interesting analysis / reports / analysis: https://www.nhes.nh.gov/elmi/index.htm

- One report that I found very helpful about 15 years ago when I was on the Budget Committee in Litchfield was the report named "New Hampshire Economic Conditions". Here is where you can find it: https://www.nhes.nh.gov/elmi/products/ec.htm

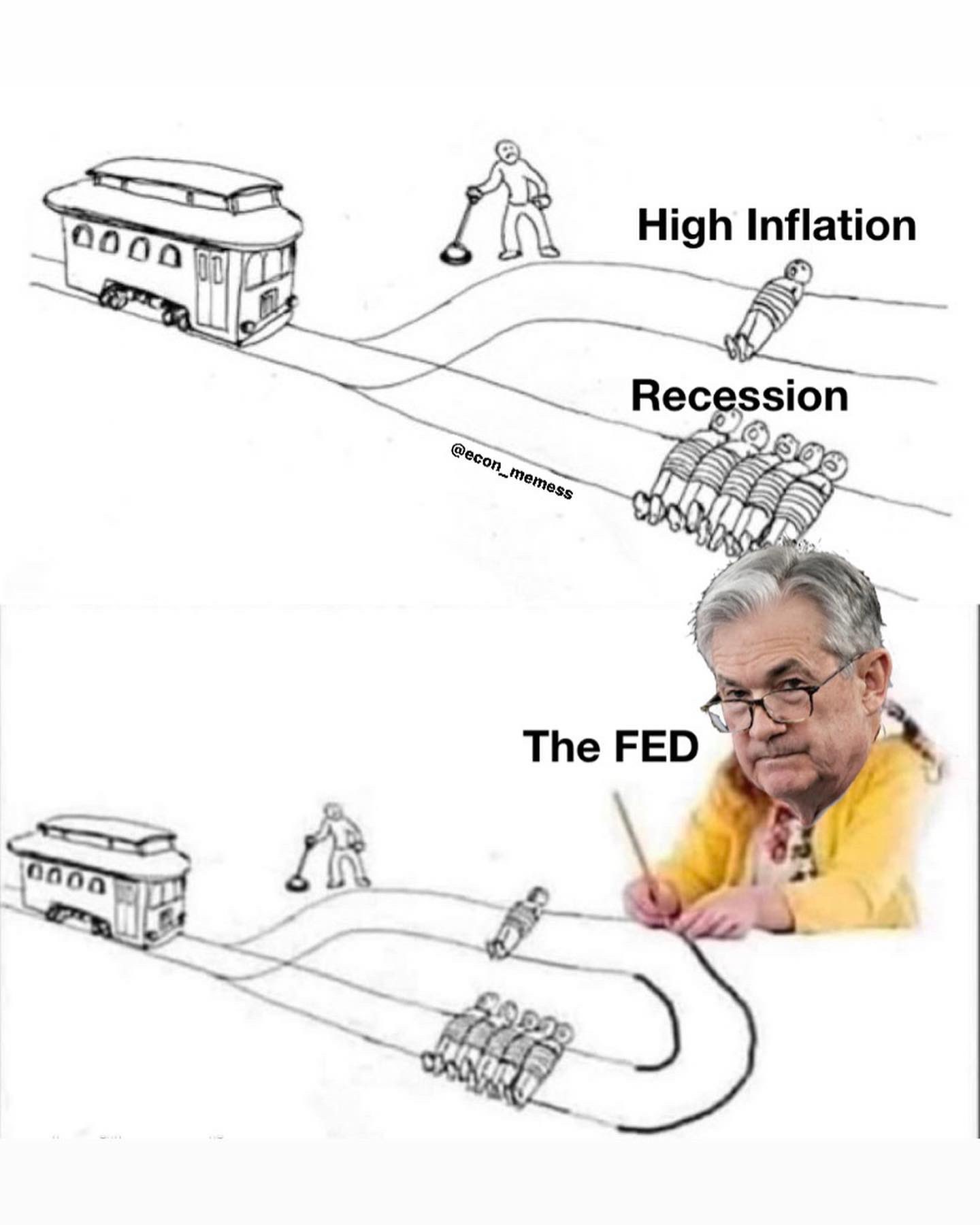

--> FEDERAL RESERVE NATIONAL PROGNOSTICATION

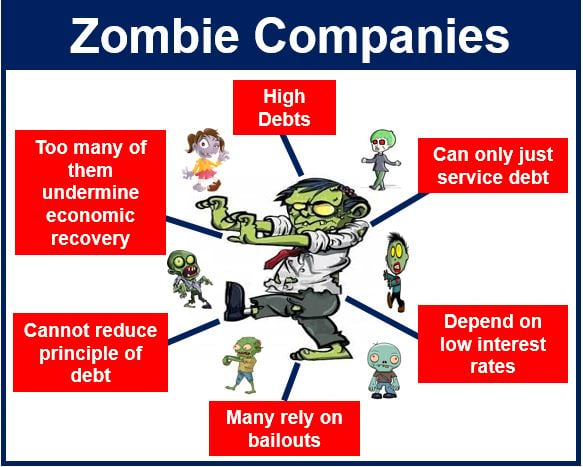

The US Government has no shortage of bodies working on measurement and predictive analysis. One such organization is technically a private organization / business, the Federal Reserve. It is a particularly important entity because is in charge of the countries money supply, and since the US Dollar is the median of exchange here, it is always one of the "products" used in every single non-barter exchange made.....so the "price of money" is key to all our economic lives.

- The Atlanta Federal Reserve Bank has a group working to estimate future economic activity (GDP) and they report their findings in their GDP_NOW forecast. Their report can be found at: https://www.atlantafed.org/-/media/documents/cqer/researchcq/gdpnow/RealGDPTrackingSlides.pdf

- More data on the GDPNow work can be found at their website: https://www.atlantafed.org/cqer/research/gdpnow.aspx

As I understand it, it must be noted that the GDP Now forecast is one that starts a quarter with projections based on models and projections and which is then continuously honed as the quarter goes on with real date coming in.....so the number changes over time as the quarter progresses. As of late, the estimate number has started out high at the start of the last two quarters and was then ratcheted down as those quarters progressed.

--> THE CONFERENCE BOARD LEI (Leading Economic Index)

The Conference Board, Inc. is a 501(c)(3) non-profit business membership and research group organization. To me is seems like a global Chamber of Commerce of sorts.

- Here is the WIKI entry on it: https://en.wikipedia.org/wiki/The_Conference_Board

Their interests go far beyond economics, and I'm not passing judgement on any of these, only pointing out that they do produce what they suggest is a forward looking predictive analysis that is considered by many for its predictions, their set of Leading Economic Indicators.

- Their latest PRESS RELEASE on their metrics can be found here: https://www.conference-board.org/topics/us-leading-indicators

- But I believe you can actually create an account and dig into their numbers more directly. You can do that here: https://data-central.conference-board.org/

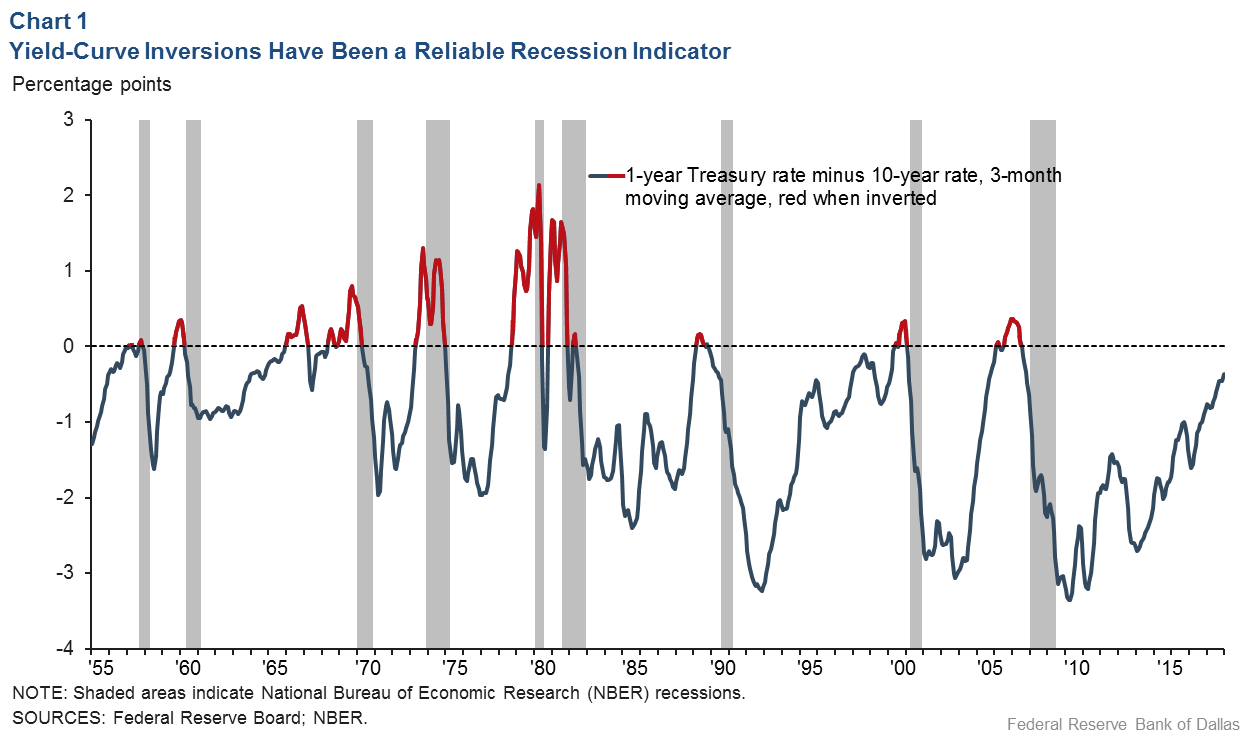

--> THE STOCK MARKET AS AN INDICATOR

Stock and Bond (and I suppose currency) markets are known to be leading economic indicators of sorts. Depending upon up much you believe in the efficient market theory, you can consider these markets as "bets" that many millions of people are making about the future of particular businesses, industries or sectors. I believe one of the Conference Boards LEI measures is in fact these markets.

One can of course just look at the general market price rises and falls as an indication of health, and this is probably valid if you consider it also takes into account a heavy dose of emotion and sentiment in the short term. They old saying is: “In the short run, the market is a voting machine but in the long run it is a weighing machine.” That doesn't mean the data is useless....in fact, if you think of it, this actually "adds" very important information to that way of measuring!

Here is another way to use stock market price flows....by looking under the surface of just the broader number and at which "sectors" are doing better or worst than others.....otherwise known as sector rotation. Just like the saying above, it has information as a short term and longer term measure....and is probably a bit like reading tea leaves in that you need to "understand" what that means. (probably done by looking at others measures and triangulating to an opinion)

- Here is a link that lets you look at prices various ETFs that invest in different companies in different sectors of the economy.....but you can create your own "mix" of stocks or FUNDS to cut across the companies or markets in any way you might find useful. (even across sectors across countries.....etc...) (you can also easily use this to look back at the visual history of any relationships you find interesting in the past and maybe correlate them with events happening back in that time....to perhaps test some theory / idea / relationship you might think exists): https://stockcharts.com/freecharts/perf.php?XRT%2CXLF%2CXLE%2CXLU%2CXLK%2CIYT%2CGDX%2CXLI%2CXLP%2CIYR

- There are of course other companies that give your ways to create your own "charts" that allow a look back at history and which of course might also have predictive value. Here is one FREE site that allows you to cut across data all sorts of ways: https://stockcharts.com/freecharts/ (of course many of the FREE looks are there to wet your appetite so you might "pay" to get your own particular stocks....but the FREE view still offers good insights. Here is an example: https://stockcharts.com/freecharts/rrg/ )

INFLATION (Growth Compared To What?)

The next important aspect of all of this is defining what I think of as the denominator in the equation.....we can look for say investment growth, but what is most important is purchasing power or growth above the level of inflation. Many of the above measuring systems do NOT take this account.....directly or indirectly.

If we want to actually measure progress, we need to consider inflation. Here are a few places that measure and predict inflation, otherwise known as devaluation of currency. (lessening of purchasing power of a currency)

Here are a few sites that give us insights into inflation and growth, in the USA and the world.

- OECD Inflation Measures across the world: https://data.oecd.org/price/inflation-cpi.htm#indicator-chart

- OECD Graphical Measure of Inflation (allows you to choose countries and timeframes): https://data.oecd.org/price/inflation-forecast.htm#indicator-chart

- OECD Producer Price Index Analysis: https://data.oecd.org/price/producer-price-indices-ppi.htm#indicator-chart

- OECD Price Level Index - Comparative price level indices are the ratios of purchasing power parities to market exchange rates.: https://data.oecd.org/price/price-level-indices.htm#indicator-chart

- OECD Housing Prices: https://data.oecd.org/price/housing-prices.htm#indicator-chart

- OECD Equity (stock) Market Prices (I suspect not inflation adjusted): https://data.oecd.org/price/share-prices.htm#indicator-chart

- Federal Reserve Bank of Cleveland INFLATION NOW prediction: https://www.clevelandfed.org/our-research/indicators-and-data/inflation-nowcasting.aspx

- IMF, Real GDP Forecast: https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD

- IMF - Variety of Datasets: https://www.imf.org/external/datamapper/datasets

- IMF - Net lending/borrowing (also referred as overall balance): https://www.imf.org/external/datamapper/GGXCNL_G01_GDP_PT@FM/ADVEC/FM_EMG/FM_LIDC

- IMF Primary net lending/borrowing (also referred as primary balance): https://www.imf.org/external/datamapper/GGXONLB_G01_GDP_PT@FM/ADVEC/FM_EMG/FM_LIDC

- Philadelphia FED GDPplus: https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/gdpplus

- Philadelphia FED Beige Book: https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/third-district-beige-book

- FED Survey of Professional Forecasters: https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/survey-of-professional-forecasters

- FED Aruoba Term Structure of Inflation Expectations (Interesting Survey): https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/atsix

- FED Aruoba-Diebold-Scotti Business Conditions Index - https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/ads

- BLS Inflation Rate Calculator: https://www.bls.gov/data/inflation_calculator.htm

WHAT TO DO WITH ALL THIS DATA?!?

That is up to you! We each need to formulate our own questions and search for the answers. I for one think that not only are there BLACK SWAN events that come about, but there are also big blind spots in the data we use....and then of course our own interpretations.....so I suppose I am a bit conservative and rist averse.....so I suggest diversification and never going "ALL IN" on any idea.